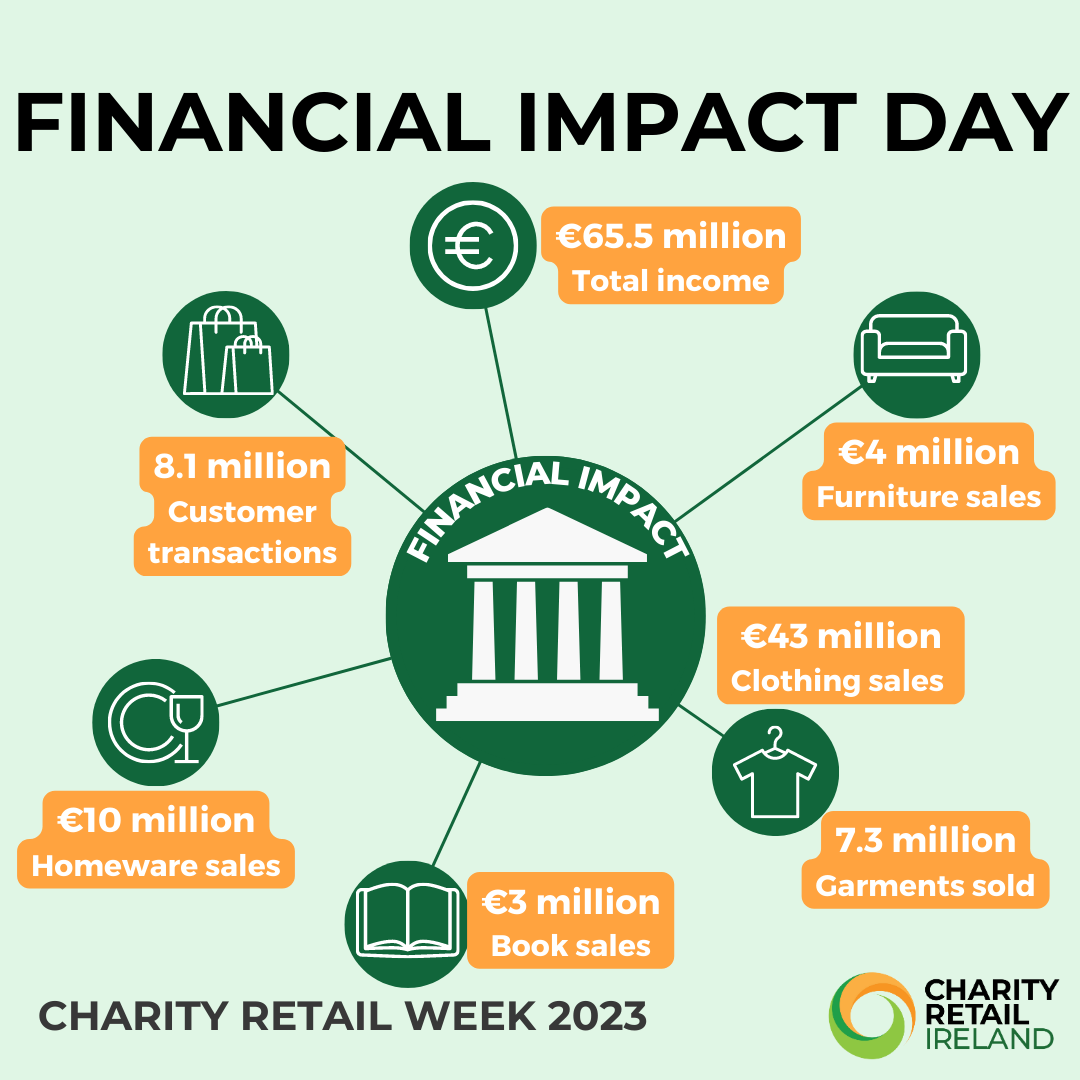

The turnover in 2022 for our 42 members operating 492 shops is €65.5 million. 2022 was a good year as it was the first full year of trading since 2019 because of the pandemic.

However success was not universal. There is a large gap between the most successful and least successful shop. The average turnover per shop was €125,000 with a variance from €50,000 at worst to €269,500 at best. The data is split into shop size.

- €125,000 – average turnover

- €107,500 – average turnover for charities with 1 shop

- €156,000 – average turnover for charities with 2-10 shops

- €124,800 – average turnover for charities with more than 10 shops

52% of our members operate 1 shop, 31% operate 2-10 shops and 17% operate more than 10 shops.

The reasons for this disparity are complex and include location, local resources, difficulty in recruiting shop managers due to full employment and getting the volunteer workforce up and running again post pandemic.

In some cases, smaller community based charities depend on their shop income for a large part of the revenue and so invest in their shops with people and resources. They are often at the heart of their local communities who support them with time, expertise and people.

Clothing sales account for the biggest proportion of sales at 66% or 7.3million garments sold. Clothing sales are likely to increase as we move to a more circular approach to fashion shopping.

Our 8.1 million customers will only increase in number in future years.

Rent and Rates

Nearly all charity shops pay rent and rates on their premises. Of the 14 charities surveyed for our Charity Impact Report 10 charities paid rates. The average paid per shop was €3,185 per year with a variance from €2,006 per year to €8,275 per year.

Charity shops are legally regarded as trading entities so are liable for commercial rates. Each local authority is responsible for collecting the rates. The rates valuation can be appealed through the local authority, who have some discretion in providing partial relief. Many local authorities do not give any rates relief to charity shops so they are charged at the full rate, hence the disparity described above.